Starting October 1, Google will be passing international tax costs to advertisers, and these fees impact more accounts than you may think. Here’s what you need to know and how you can prepare for October 1.

What to Know About Google’s International Ad Tax Update

Per Google Ads Help, “Google Ads will begin charging new surcharges for ads serving in specific jurisdictions.” These fees will appear after the end of the month if the account is on invoicing or if it’s on a CC after the individual charges go through.

It’s important to note that these fees are charged to accounts if a user is in one of the locations listed, even if the campaign isn’t targeting that region if your account has targeting set to “people in or who show interest in your targeted location.”

For example, a New York City real estate company may have settings enabled for geotargeting. A user in one of these newly taxable jurisdictions could be searching for NYC apartments and the tax will be charged on the user’s click (or impression if it’s CPM-based i.e. YouTube). Be sure to read through all of the details of your account settings and new surcharges to fully understand how this will impact your ads.

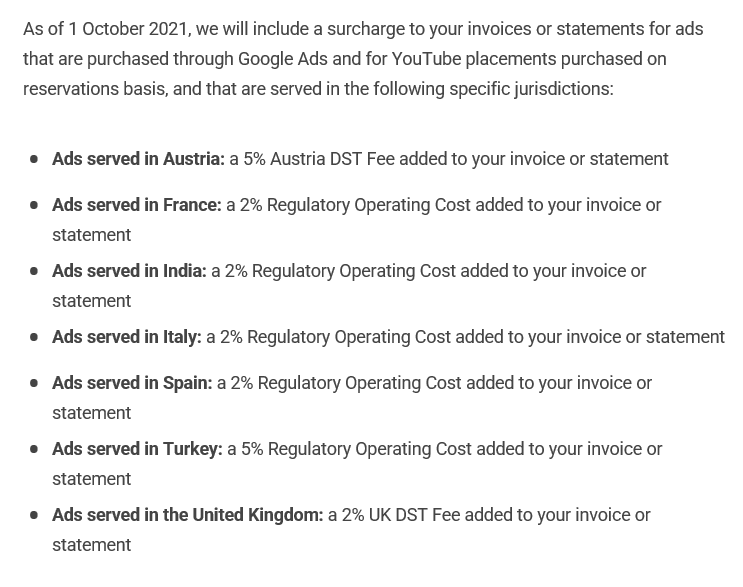

Countries Where Tax Jurisdictions Apply

What to Do About Google’s International Ad Tax Update

Depending on the status of your account and advertising, there are several different action items you may need to take.

If your account is advertising within the above jurisdictions:

- Communicate these fee changes to all relevant stakeholders

- Confirm whether these taxes are inclusive or exclusive of your budget and how this will impact reporting

- Since these taxes will only be seen on invoices or statements and not in Google Ads UI, be sure to communicate and confirm these fees as they occur

- To track in one country accounts or multi-country accounts, set up a custom column in Google Ads with the % added on and you’ll be able to track just that spend

If your account is NOT advertising in the above jurisdictions but has “show interest in your targeting location” enabled for any number of business reasons:

- Communicate this change and confirm with stakeholders you do want to show up for any of the above jurisdictions

- Confirm whether these taxes are inclusive or exclusive of your budget

- While difficult to project before October 1, you can provide an estimate based on historical ad serving data to get what % of traffic and spend comes from users within the taxed jurisdictions

Regardless of this upcoming change, all advertisers should make sure to only be targeting audiences within targeted locations, as necessary. As an extra precaution, you can exclude these countries with fees from targeting.

It is possible for a campaign that doesn’t explicitly target a particular jurisdiction, for example, the United Kingdom, to show ads to users in the United Kingdom because your business might be in a location of interest for those users. Therefore, it’s the advertiser’s responsibility to ensure that your campaign target settings are correct and the ads are served in the intended jurisdictions. Google will not refund the Regulatory Operating Costs or DST Fees that were levied as a result of legitimate clicks and impressions served according to your campaign target settings.

Google Team

We will update this article after October 1 to share the on-the-ground impacts of these international fee changes for advertisers. Stay tuned and in the meantime, learn more paid media insights. Read Google Discovery Ads: Optimize Campaigns + Save Time with the Modern Search Journey.